Devon Energy is considering establishing a joint venture (JV) to develop its Horn River shale gas assets in the Canadian province of British Columbia. The company had been approached by potential JV partners for BC's Kitimat liquefied natural gas export project. Interest in North American shale assets from foreign oil companies has heated up in recent months, with some paying top dollar for access to shale fields that hold vast amounts of natural gas. It is highly likely that an Asian NOC had been in discussions with Devon over a tie-up at Horn River. Such a development would boost the prospects for Kitimat LNG.

Following the recent Asians invasion into the Canadian Shales, it is not surprising that investors are attracted to a partnership with Devon at Horn River Basin. The BC shale play is the source of the gas that Apache intends to liquefy at the Kitimat project, which Devon is also eyeing as the route to market for its own Horn River gas.

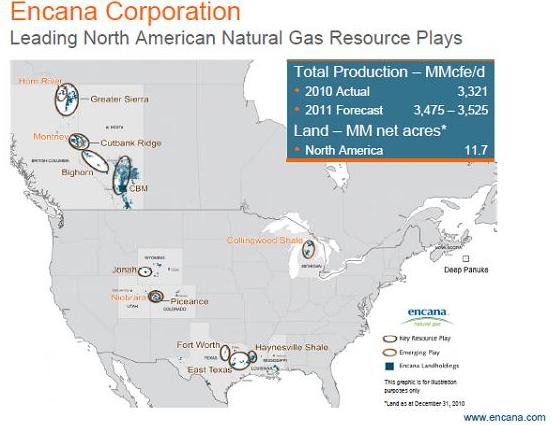

Devon going Encana way

Devon's stated openness to a JV comes less than two months after Canadian gas producer Encana struck a landmark CAD5.4bn (US$5.5bn) deal with state-run PetroChina to develop its Cutback Ridge shale gas project in the Montney formation. Encana subsequently acquired a stake in Kitimat, strongly suggesting that Apache and Encana were keen to involve PetroChina in the development of Canada's first LNG export project.

Looks like Devon is attempting to emulate Encana's success in securing development cash for its unconventional gas play. Specifically, we think it is likely that Devon has been talking with Asian national oil companies. Not only is the lucrative Asia-Pacific market the likely destination for LNG cargoes to be exported from Kitimat, but Chinese and South Korean NOCs in particular are keen to develop their unconventional gas skills

Devon’s assets in HRB

Devon's largely undeveloped Horn River Basin position totals 688sq km, with estimated 'net risked resources' of 227.5bn cubic metres equivalent (bcme) as of February 2011. Much of this acreage is located in close proximity to Encana and Apache's Horn River positions, further supporting the possibility of a development tie-up, with Kitimat as a pipeline destination.

Please try our new free document search tool: www.derrick petroleum.com

With the increased natural gas demand and better LNG market conditions prevailing in Asia, Devon might end up signing a joint venture with Chinese, Koreans or other Asians.

Deal snapshot