Eagle Rock Energy Partners LP agreed to acquire all of the equity interests in CC Energy II LLC with reserves located in multiple basins across Oklahoma, Texas and Arkansas, for total consideration of $525 million. The total consideration includes approximately $303 million of Eagle Rock equity to be issued to the sellers, $15 million of cash and $207 million of assumed debt.

Highlights of the Crow Creek properties include the following:

- Net production in the first quarter of 2011 of approximately 47 MMcfe/d

- Total proved reserves of 268 Bcfe (80% gas and 66% proved developed)

- Total 3P (proved, probable and possible) reserves of 740.5 Bcfe

- Core operating areas include 327 operated wells and 1,040 non-operated wells on approximately 115,500 net acres across the Golden Trend Field, Verden Field and the Cana Shale Play

- 182 proved drilling locations and more than 450 probable drilling locations

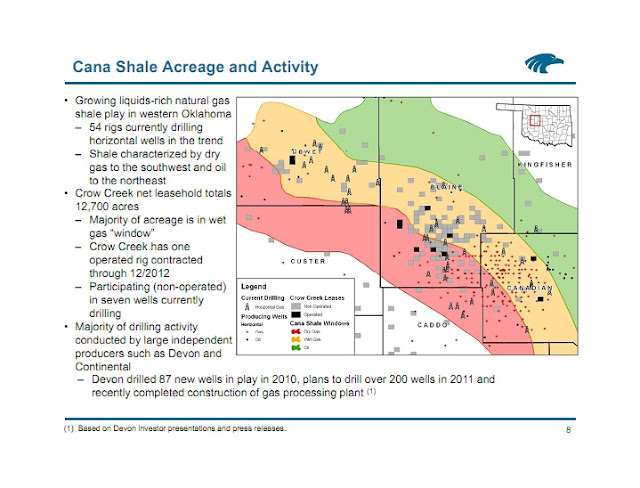

- Approximately 12,700 net acres with 434 identified drilling locations in the emerging Cana Shale play in Oklahoma. This area has recently experienced a high level of horizontal drilling activity, with 54 rigs currently active across the trend

- Reserve life index of over 20 years

- 75% operated (based on 2011 expected production)

- Assumption of Crow Creek Energy's current commodity hedges which had a mark-to-market value of approximately $10.8 million as of April 6, 2011.

Cana Shale at ~$5,000/acre is booming up like senior shale gas producers!

The following slide from Cimarex gives the economics of Cana Shale well

Cana is the world’s deepest commercial horizontal shale play (11,500 – 14,500 ft TVD). The active operators of the play include Cimarex Energy, Continental Resources and Devon Energy. Cimarex Energy holding 100,000 net acres in Cana Shale play had drilled 112 gross wells in 2010, completing 86 of these. In 2011, Cimarex Energy plans to drill 100 gross wells equipping 8-9 rigs. Cimarex’ estimated 2011 drilling capital allocated for this play is $340 million. Devon drilled 87 new wells in play in 2010, and plans to drill over 200 wells in 2011.

With the industry players’ increasing interest in Cana Shale play and a new metric milestone set at $5,000/acre, Cana play is yet to magnetise many more oil and gas players. Cana Shale play - the new born shale is booming well!

The following snapshot shows the other significant deal in Cana Shale.