A short note on Haynesville Shale- which beat Barnett in production!!

Haynesville’s rig count has increased 11% over the past year to 168 rigs as against the Barnett’s 31% decline to 53 rigs. The drilling pace in Haynesville is ramping up due to the Barnett having many matured producing wells versus the Haynesville just speeding up the production since 2007 when the first well was hit by Chesapeake. Another reason for continued drilling in the Haynesville Shale in 2011 despite weak natural gas prices is the existence of some independent companies like BG, ExxonMobil and EXCO. These independents, in 2010, gave a new outlook to Haynesville Shale lifting the metrics to ~15,000/acre.

Source: Global Oil and Gas M&A Review

Try our free document search tool: http://www.derrickpetroleum.com/

Haynesville runs @ high metrics of ~15,000/acre

The Haynesville's average 2010 metrics of ~$15,000/acre had increased 67% from the average 2009 metrics of $9,000/acre. The Haynesville metrics is the highest of all the other unconventional gas plays! Observing the growth in Haynesville Shale play, it might become a replica of Barnett.

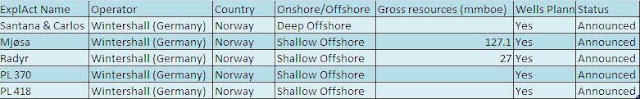

Here is the snapshot of a Haynesville package up for sale.

Source: Derrick Petroleum E&P Transactions Database

A recent report by the US Energy Information Administration on US gas production said the Haynesville is now producing at least 5.5 Bcf/d and overtook the Barnett Shale's production of 5.3 Bcf/d. The production from the Haynesville shale increased from 0.4 Bcf in 2007 to 410.9 Bcf in 2009. The production from the play is expected to increase to 2,328.4 Bcf in 2020 at an average annual growth rate of 15.8%. Some industry experts believe the Haynesville shale could ultimately produce as much as 30 to 40 trillion cubic feet of natural gas.

Haynesville’s rig count has increased 11% over the past year to 168 rigs as against the Barnett’s 31% decline to 53 rigs. The drilling pace in Haynesville is ramping up due to the Barnett having many matured producing wells versus the Haynesville just speeding up the production since 2007 when the first well was hit by Chesapeake. Another reason for continued drilling in the Haynesville Shale in 2011 despite weak natural gas prices is the existence of some independent companies like BG, ExxonMobil and EXCO. These independents, in 2010, gave a new outlook to Haynesville Shale lifting the metrics to ~15,000/acre.

Source: Global Oil and Gas M&A Review

Try our free document search tool: http://www.derrickpetroleum.com/

Haynesville runs @ high metrics of ~15,000/acre

The Haynesville's average 2010 metrics of ~$15,000/acre had increased 67% from the average 2009 metrics of $9,000/acre. The Haynesville metrics is the highest of all the other unconventional gas plays! Observing the growth in Haynesville Shale play, it might become a replica of Barnett.

Here is the snapshot of a Haynesville package up for sale.

Source: Derrick Petroleum E&P Transactions Database