CNOOC plans to spend as much as 1 trillion yuan ($151 billion) in the five years through 2015 to boost production, China Business News reported, citing President Fu Chengyu, of which US $53 billion is for China alone. At $30 billion/year capex, CNOOC will spend more than the Supermajors. Chevron, Shell, ExxonMobil, Conocophillips, BP and Total plan to spend between $20 billion to $30 billion per year for next five years from 2011 to 2015.

CNOOC's immediate plans for 2011:

CNOOC announced its 2011 strategy plan and development plan to spend about US $8.77 billion in the coming year of which capital expenditure for exploration, development and production is US$1.56 billion, US$5.05 billion, and US$2.02 billion respectively.

CNOOC's immediate plans for 2011:

CNOOC announced its 2011 strategy plan and development plan to spend about US $8.77 billion in the coming year of which capital expenditure for exploration, development and production is US$1.56 billion, US$5.05 billion, and US$2.02 billion respectively.

- 2011 exploration program remains intensive with 96 exploration wells, 19,967 km of 2D seismic and 17,129 sq km of 3D seismic

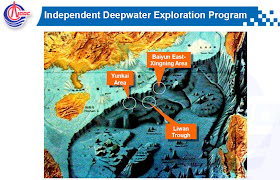

- More efforts in independent deepwater exploration especially in South China sea will be made in 2011, including 2-3 deepwater wells and more seismic data

Increase in production target

- The total net production of the Company in 2011 is targeted at 0.972 - 1 MMBOE/D (assuming with WTI at US$82.0/barrel). The Company’s net production for 2010 is estimated to be 0.895 – 0.901 MMBOE/D (with WTI at US$79.5/barrel)

- Four new projects offshore China expected to come on stream, including major projects such as Jinxian1-1 and Jinzhou 25-1

- Eagle Ford project in the U.S. and Bridas Corporation in Argentina are expected to deliver production

- 15 projects are under construction, driving the mid to long term production growth of the Company